WeMove Europe is an independent and values-based organisation that seeks to build people power to transform Europe in the name of our community, future generations and the planet.

to the European Commission and to the EU Economy and Finance Ministers

Petition text

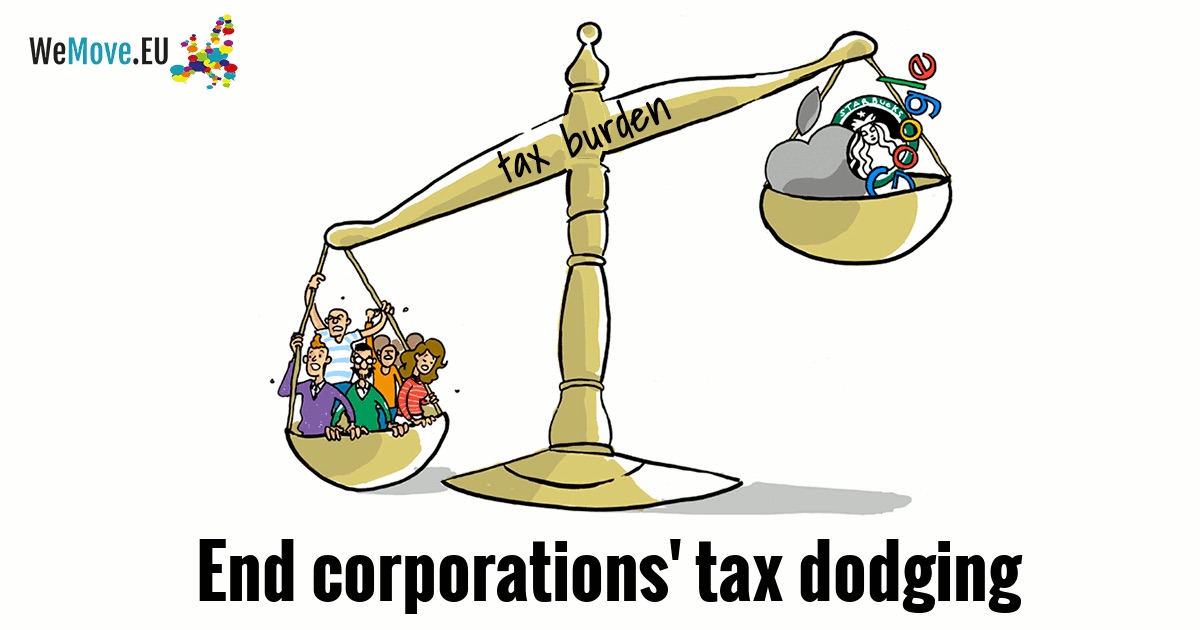

The scandalous accounting tricks being used by multinational corporations to shift their revenue to wherever taxes are lowest, is costing all of us billions. This has to end. As a minimum first step, we ask that corporations are made to publicly declare how much they pay in taxes and what business activities they carry out in each country where they operate.

Why is this important?

We likely pay more tax than wealthy corporations. Google for example paid less than 3% in taxes over the past years using legal loopholes in Ireland [1]. Belgium recently allowed around 35 big corporations to use more loopholes in order to avoid paying 700 million euros in taxes [2].

While citizens have to pay taxes, most countries in Europe let wealthy multinational corporations get away with dodging billions of euros. Conservative estimates show this actually costs Europeans between €50 to €70 billion every year. [3].

The European Union is now looking into forcing corporations to be transparent about how much tax they pay. That way everyone can see if they have tried to hide profits and how much they actually owe. But corporations are fighting hard to water it down, to the point where it’s useless in the fight against tax dodging.

If the final directive ends up with the type of reporting corporations’ want, we would get weak data that wouldn’t reveal whether corporations are engaged in aggressive tax planning and profit shifting, and we’d get it from fewer than 15% of all companies. It would mean that corporations and wealthy individuals can simply shift their profits to tax havens outside the EU and continue to dodge tax.

If the Commission and the Council side with the European people it will show they are serious about providing solutions by cracking down on corporate tax dodging.

Siding with us means ensuring the proposal has teeth. It means all companies in the EU are obliged to report publicly, no matter where their headquarters are; that they report on their activities in all countries, not just EU countries; and that 85% of companies are not exempted from reporting.

[1] Google UK deal strestches Osborne's patience

[2] Belgian tax rules are illegal state aid

[3] Bringing transparency to corporate tax policy in the EU.

[4] In policy jargon this is known as Country by Country Reporting or CBCR